Youwind Renewables, a leading provider of web-based solutions for optimizing early-stage offshore wind development, has announced that Acciona Energía, a global leader in renewable energy, is using its technology to accelerate offshore wind site selection and evaluate its current pipeline of projects.

With nearly 30 years of experience in the development, construction, operation, and maintenance of wind farms, Acciona Energía has established itself as a frontrunner in the renewable energy sector. The company boasts an impressive portfolio, comprising over 6,500 wind turbines and a total installed capacity of 13,500 MW - of which 9,387MW correspond to onshore wind. The business is now seeking to expand its presence in offshore wind, exploring development opportunities across several global territories

Since 2023, Acciona Energía has been using Youwind's advanced web-based tools for the evaluation of offshore wind development opportunities, including its Pixel area screening tool, and Pixel Park layout optimization tool.

Pixel helps to identify the optimum locations for wind farm development based on technical and financial factors, producing a Levelized Cost of Energy (LCoE) heat map to support the rapid selection of promising sites.

Pixel Park is an advanced web-based application designed to generate detailed wind farm layouts rapidly for any site worldwide, taking into account site-specific bathymetry and geography. This tool allows users to model the technical and financial performance of layouts, including all major wind farm components such as turbines, foundations, substations, and cable routes, for floating and fixed-bottom installations. Moreover, Pixel Park can simulate and evaluate layouts that incorporate crucial redundancy and resiliency measures, such as multiple offshore substations connected by an interlink.

"We are thrilled to work with Acciona Energía. We know Youwind can enhance and help them accelerate their offshore wind development initiatives," said Anna Rivera, CEO and co-founder of Youwind Renewables. "Together we have fostered a collaborative way of working, providing a great demonstration of how industry leaders like Acciona can boost their processing power to optimize project development and drive sustainable energy innovation forward."

Youwind Renewables | https://youwindrenewables.com/

SEAONICS will supply 3D Electric Controlled Motion Compensated (ECMC) cranes to two Commissioning Service Operation Vessels (CSOVs) under construction for the German shipowner at Norwegian shipbuilder VARD. The order marks the 9th and 10th units sold since the first next-generation ECMC crane was delivered last year.

Ambitious new customer

The order marks SEAONICS' first equipment delivery to Windward Offshore, a company founded by Blue Star Group, Diana Shipping Inc and SeraVerse, in collaboration with and under the leadership of SeaRenergy Group. The first CSOV is scheduled for delivery in the second half of 2025, with the remaining vessel following in 2026. The partners are united by a shared vision of pioneering excellence in the offshore wind sector.

"We are pleased to announce our partnership with SEAONICS delivering cutting-edge ECMC C25 3D cranes for our CSOVs. Equipping two of our vessels with these advanced seven-ton units will bring a big operational advantage for our charterers in their offshore projects," said Windward Offshore Managing Director, Benjamin Vordemfelde.

Vice President Sales at SEAONICS, Ståle Fure, commented: “It’s a privilege to welcome Windward Offshore as our newest customer. We’re excited to support their journey. Our goal is to ensure not only their success and satisfaction but also of VARD. We can't wait to see the cranes in operation.”

Milestone achievement

SEAONICS delivered its first ECMC crane last year; the fact that 10 units have now been purchased in a relatively short time proves the market recognizes the product's flexibility and robust functionalities.

“This latest order underscores the trust placed in SEAONICS’ innovative technology and highlights our commitment to delivering specialized solutions for our clients,” Fure added.

Designed for demanding operations

The ECMC C25 3D Crane features a fully electrically controlled motion compensation system, ensuring smooth and precise movements even in challenging conditions.

The boom control, slew control and telescope control are all electric driven and used dynamically to enable 3D compensation of the crane tip. The simplified design promotes operational safety and efficiency, reducing the time and effort required for cargo handling.

SEAONICS | www.seaonics.com

Windward Offshore | www.windward-offshore.com

Soltec, a vertically integrated company dedicated to photovoltaic projects with solar trackers, will supply 200 MW of its SF7 tracker for five projects by Grupotec. The photovoltaic plant will be located in the province of Almería in Andalucia, Spain. This installation not only reflects our commitment to environmental sustainability but also promotes regional economic development by creating numerous jobs during its construction phase, directly benefiting the local community.

The solar plant will be equipped with the SF7 solar tracker, one of the flagship trackers of the company. This tracker features a 2P (two modules in vertical) configuration and stands out for its great adaptation to the terrain and its efficiency in both installation and operation and maintenance. The project will have a total of 4501 solar trackers and 347,244 photovoltaic modules.

The installation of this solar plant will contribute to avoiding the emission of about 108,000 tons of CO2 into the atmosphere. Additionally, the energy generated in the solar plant corresponds to the amount needed to power more than 114,000 households.

"At Soltec, we are immensely excited to collaborate on this significant project with Grupotec. Our commitment to decarbonizing the economy is firm, and it is a privilege for us to continue contributing to this cause in our country through initiatives as relevant as this, collaborating with our innovation, our products, and our service with major clients like Grupotec," said Raúl Morales, CEO of the company.

Soltec | https://soltec.com/en/

Smart panel pioneer Lumin announced that the Lumin Smart Panel is now integrated with the Tesla Powerwall family of home batteries to read and respond to state of charge. This includes Powerwall+, Powerwall 2 and Powerwall 3 batteries.

Lumin’s products have always been compatible with all batteries, inverters, and load centers, including Powerwall. This latest integration enables intelligent energy optimization based on the battery’s state of charge, resulting in extended backup runtime.

How: By monitoring the battery’s state of charge, Lumin automatically sheds less important loads as the battery draws down, based on the homeowner’s priorities.

Rollout: The integration requires homeowners to have the latest version of the Lumin app on their mobile device and the newest operating system installed on their Lumin Smart Panel. If you add the integration while using an older operating system, the app will prompt the user to request an update, enabling the feature.

Lumin will enable automatic updates in the next few months to eliminate this step. Also, all new Lumin Smart Panels will be shipped with the latest operating system, enabling Powerwall integration.

Integrations: The Lumin Smart Panel now reads state of charge for Tesla Powerwall, Enphase IQ, and SolarEdge Home batteries, covering approximately 70% of the solar-plus-storage market.

Market Coverage: As of December 2023, Tesla ranked first among residential batteries with a 47% market share of the residential solar-plus-storage market, followed by Enphase with 17% (ranked second) and SolarEdge with roughly 6% (ranked fifth). Combined, these companies cover approximately 70% of the solar-plus-storage market.

Tesla’s Storage Growth: Tesla’s energy business is growing faster than its car business. The company deployed just over 4 gigawatts of energy storage in the first quarter of the year, and its energy revenue was up 7% from a year ago. Profits from the business more than doubled.

Lumin | https://www.luminsmart.com/

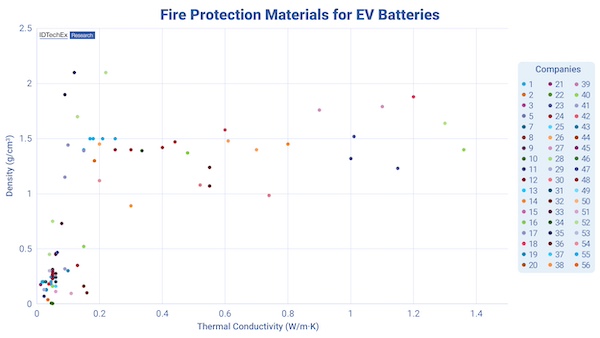

The protection of electric vehicle (EV) batteries from thermal runaway and fire is an important topic. Safety is paramount for the automotive industry and regulations are starting to catch up, implementing escape times and other measures to improve safety. The large variety in battery pack designs and OEM requirements has led to the adoption of many different types of materials to prevent or delay the propagation of thermal runaway. With the rapidly growing EV market, there is certainly a large opportunity to be had for material suppliers, with IDTechEx predicting a 16.3% CAGR for EV battery fire protection materials from 2023 to 2034.

However, over the past couple of years, IDTechEx has seen a very large number of material suppliers entering this space. Some are repurposing existing materials, and some are making dedicated solutions. But at this stage, almost every major materials supplier has at least one option for a material that can be used for this application.

IDTechEx findings from industry events

In January 2024, IDTechEx attended Automotive World 2024 in Tokyo, Japan. The event observed materials such as encapsulating foams from Dow and H.B. Fuller. While these have been primarily used for cylindrical cell systems, there are also opportunities for these to expand adoption to use between prismatic and pouch cells.

IDTechEx also saw Denka and Fujipoly exhibiting a fiberglass material with endothermic additives and a silicone rubber, respectively. Stanley Engineered Fastening is entering this space too; it showcased thermal fins, swelling compensators, and thermal barriers as part of its thermal management solution for EV battery packs.

Applications are not just between cells; Fujikura showed a graphite-based intumescent material that expanded to form a protective layer around the seal of a battery pack in the event of high temperatures.

At InterBattery 2024, IDTechEx observed players such as Shinsung C&T, Wacker, 3M, Alkegen, and Aspen Aerogels displaying materials that can aid in the fire safety of EV batteries. Aerogels are certainly a material with increased interest thanks to their low density and thermal conductivity; despite some historic challenges around dustiness and high costs, aerogels are starting to see increased adoption with players like Aspen and Alkegen. IDTechEx's report, "Aerogels 2024-2034: Technologies, Markets and Players", predicts the market for aerogels will exceed US$2.6 billion by 2034, a huge increase from its hundreds of millions today, largely driven by the EV battery sector.

It should be noted that the materials mentioned above are at various stages of commercialization, from development projects through to mass-produced materials, and this is just a small subset of the players on the market. In fact, IDTechEx's database of materials now includes over 130 materials used for EV battery fire protection.

Challenges for material suppliers

One of the challenges material suppliers face is the supply chain; for example, some OEMs source battery modules already assembled from China or Korea, meaning the OEM has little impact on the materials used between cells, and a supplier may have to go directly to the battery manufacturer, although this situation appears to be changing with greater development of in-house OEM production. Many OEMs also have strong existing relationships with material suppliers from other components, making entry for new players more challenging, especially if they are not used to the volumes required for the automotive industry.

Materials must balance properties such as thermal conductivity, density, thickness/volume, dielectric strength, maximum protection temperature, and, ultimately, cost. Due to the inherent pros and cons of each material, suppliers may find their portfolio more or less suited to various applications for the battery; for example, protection between cylindrical, prismatic, or pouch cells, module level protection, pack lid protection, busbar protection, seal protection, vent protection, or several others.

EV fire protection material opportunities

Despite the challenges, the rapidly growing EV market with an increased focus on fire safety presents good opportunities for many players to operate in this field. Cars are not the only market electrifying either, with sectors like micromobility, trucks, and buses also presenting strong growth in electrification, leading to opportunities outside of the automotive market. IDTechEx predicts that segments outside automotive will account for 19% of the revenue made by fire protection materials for on-road EV segments in 2034, a nearly 9-fold increase in its value today.

IDTechEx's report "Fire Protection Materials for EV Batteries 2024-2034: Markets, Trends, and Forecasts" predicts the market share and growth for various categories of materials, including ceramic sheets, mica sheets, encapsulating foams, aerogels, coatings (fire retardant and intumescent), phase change materials, and others. The report considers upcoming regulations and the shifts in battery design, such as cell format, cell-to-pack, and more, to determine volume and value forecasts across on-road vehicle categories, including cars, vans, trucks, buses, 2-wheelers, 3-wheelers, and microcars.

For more information on this report, please visit www.IDTechEx.com/FPM.

IDTechEx | www.idtechex.com

Stäubli North America announced major new investments to expand its manufacturing and assembly operations, continuing to expand capacity in their plants in South Carolina and California. Stäubli is a market leader connecting more than 50% of PV capacity worldwide, ensuring long-lasting and reliable solar power transmission.

The company established its North American presence in 1980 in Duncan, South Carolina. Today, the 103,000-square-foot facility houses manufacturing, logistics and personnel to operate and support the company’s different divisions. In 2011, the company expanded with a 43,000-square-foot manufacturing facility for electrical PV connectors and other products in Windsor, California.

“We plan to steadily increase our made-in-America products at these manufacturing facilities,” said Brian Mills, Head of Renewable Energy, North America.

“Increasing our already established solar connector manufacturing footprint in the U.S. puts Stäubli in a strong position to support the increasing demand for domestically made components driven in part by the Inflation Reduction Act of 2022,” Mills added.

Stäubli North America is celebrating more than 15 years of PV component manufacturing in the USA. Known for the industry-leading MC4 connector, Stäubli has a history of manufacturing a wide range of solar solutions including junction boxes, in-line fuses and eBOS products domestically.

These components include Stäubli’s Original MC4 and MC4-Evo 2 cable couplers, in-line fuses, the first PV cable coupler for 6 AWG, junction boxes, and modular DC wire Harnesses.

In addition to its capital investments in domestic manufacturing, Stäubli North America has added capabilities to its locally-based Field Engineers, Design Engineers, and test lab resources to now offer a new customer support offering of Field Services and technical training.

“This comprehensive support is unique in the industry and extends through each critical stage of a solar project: from initial design, through pre-construction and construction, right up to the operational phase. This includes support of proper product selection and assembly, optimized design for limited waste and power loss, and proper implementation of the product in the field to ensure that our customers achieve safe and reliable solar installations.” said Mills.

“Our advanced manufacturing operations employ the latest automation with 100% inspection to maintain the highest standards in quality, performance, safety, and sustainability. Plus, we have the agility to serve specific sectors with customized Engineering To Order and Make to Order solutions to meet our customers’ specific requirements.”

Stäubli | www.staubli.com

The Oceantic Network celebrates the announcement by the Bureau of Ocean Energy Management (BOEM) of two new offshore lease sales in the Gulf of Maine and off the Oregon Coast. This morning, BOEM issued Proposed Sale Notices (PSNs) for nearly one million acres in the Gulf of Maine, enough to host 15 GW of projects, and just under 200 thousand acres off the coast of Oregon, the second on America’s West Coast and an area with the potential to power over a million homes.

These two new PSNs represent a potential 18 GW of clean, renewable energy and are the first of a dozen offshore wind lease auctions the Department of Interior announced last week during the Network’s 2024 International Partnering Forum (IPF), the largest offshore wind conference in the Americas. U.S. Secretary of the Interior Deb Haaland made the announcement during the conference’s Plenary Session and later that same day, Maine Governor Janet Mills took the stage to announce her state’s intention to secure up to 3 GW of offshore wind power generation in an upcoming solicitation round. The state simultaneously released a Request for Information seeking public input on the solicitation.

The following statement can be attributed to Liz Burdock, CEO of Oceantic Network:

“BOEM's combined announcement solidifies two new regional markets for floating offshore wind, balancing the development of this industry sector across both coasts. New lease areas in Oregon will support a further buildout of the West Coast’s regional supply chain, adding strength to California projects. And in the Gulf of Maine, this new 15 GW potential will drive the creation of a floating offshore wind supply chain on the East Coast.”

Oceantic Network | https://oceantic.org/

Alternative Energies May 15, 2023

The United States is slow to anger, but relentlessly seeks victory once it enters a struggle, throwing all its resources into the conflict. “When we go to war, we should have a purpose that our people understand and support,” as former Secretary ....

Unleashing trillions of dollars for a resilient energy future is within our grasp — if we can successfully navigate investment risk and project uncertainties.

The money is there — so where are the projects?

A cleaner and more secure energy future will depend on tapping trillions of dollars of capital. The need to mobilize money and markets to enable the energy transition was one of the key findings of one of the largest studies ever conducted among the global energy sector C-suite. This will mean finding ways to reduce the barriers and uncertainties that prevent money from flowing into the projects and technologies that will transform the energy system. It will also mean fostering greater collaboration and alignment among key players in the energy space.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

Interestingly, the study found that insufficient access to finance was not considered the primary cause of the current global energy crisis. In fact, capital was seen to be available — but not being unlocked. Why is that? The answer lies in the differing risk profiles of energy transition investments around the world. These risks manifest in multiple ways, including uncertainties relating to project planning, public education, stakeholder engagement, permitting, approvals, policy at national and local levels, funding and incentives, technology availability, and supply chains.

These risks need to be addressed to create more appealing investment opportunities for both public and private sector funders. This will require smart policy and regulatory frameworks that drive returns from long-term investment into energy infrastructure. It will also require investors to recognize that resilient energy infrastructure is more than an ESG play — it is a smart investment in the context of doing business in the 21st century.

Make de-risking investment profiles a number one priority

According to the study, 80 percent of respondents believe the lack of capital being deployed to accelerate the transition is the primary barrier to building the infrastructure required to improve energy security. At the same time, investors are looking for opportunities to invest in infrastructure that meets ESG and sustainability criteria. This suggests an imbalance between the supply and demand of capital for energy transition projects.

How can we close the gap?

One way is to link investors directly to energy companies. Not only would this enable true collaboration and non-traditional partnerships, but it would change the way project financing is conceived and structured — ultimately aiding in potentially satisfying the risk appetite of latent but hugely influential investors, such as pension funds. The current mismatch of investor appetite and investable projects reveals a need for improving risk profiles, as well as a mindset shift towards how we bring investment and developer stakeholders together for mutual benefit. The circular dilemma remains: one sector is looking for capital to undertake projects within their skill to deploy, while another sector wonders where the investable projects are.

This conflict is being played out around the world; promising project announcements are made, only to be followed by slow progress (or no action at all). This inertia results when risks are compounded and poorly understood. To encourage collaboration between project developers and investors with an ESG focus, more attractive investment opportunities can be created by pulling several levers: public and private investment strategies, green bonds and other sustainable finance instruments, and innovative financing models such as impact investing.

Expedite permitting to speed the adoption of new technologies

Another effective strategy to de-risk investment profiles is found in leveraging new technologies and approaches that reduce costs, increase efficiency, and enhance the reliability of energy supply. Research shows that 62 percent of respondents indicated a moderate or significant increase in investment in new and transitional technologies respectively, highlighting the growing interest in innovative solutions to drive the energy transition forward.

Hydrogen, carbon capture and storage, large-scale energy storage, and smart grids are some of the emerging technologies identified by survey respondents as having the greatest potential to transform the energy system and create new investment opportunities. However, these technologies face challenges such as long lag times between conception and implementation.

If the regulatory environment makes sense, then policy uncertainty is reduced, and the all-important permitting pathways are well understood and can be navigated. Currently, the lack of clear, timely, and fit-for-purpose permitting is a major roadblock to the energy transition. To truly unleash the potential of transitional technologies requires the acceleration of regulatory systems that better respond to the nuance and complexity of such technologies (rather than the current one-size-fits all approach). In addition, permitting processes must also be expedited to dramatically decrease the period between innovation, commercialization, and implementation. One of the key elements of faster permitting is effective consultation with stakeholders and engagement with communities where these projects will be housed for decades. This is a highly complex area that requires both technical and communication skills.

The power of collaboration, consistency, and systems thinking

The report also reveals the need for greater collaboration among companies in the energy space to build a more resilient system. The report shows that, in achieving net zero, there is a near-equal split between those increasing investment (47 percent of respondents), and those decreasing investment (39 percent of respondents). This illustrates the complexity and diversity of the system around the world. A more resilient system will require all its components – goals and actions – to be aligned towards a common outcome.

Another way to de-risk the energy transition is to establish consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation. The energy transition depends on policy to guide its direction and speed by affecting how investors feel and how the markets behave. However, inconsistent or inadequate policy can also be a source of uncertainty and instability. For example, shifting political priorities, conflicting international standards, and the lack of market-based mechanisms can hinder the deployment of sustainable technologies, resulting in a reluctance to commit resources to long-term projects.

Variations in country-to-country deployment creates disparities in energy transition progress. For instance, the 2022 Inflation Reduction Act in the US has posed challenges for the rest of the world, by potentially channeling energy transition investment away from other markets and into the US. This highlights the need for a globally unified approach to energy policy that balances various national interests while addressing a global problem.

To facilitate the energy transition, it is imperative to establish stable, cohesive, and forward-looking policies that align with global goals and standards. By harmonizing international standards, and providing clear and consistent signals, governments and policymakers can generate investor confidence, helping to foster a robust energy ecosystem that propels the sector forward.

Furthermore, substantive and far-reaching discussions at international events like the United Nations Conference of the Parties (COP), are essential to facilitate this global alignment. These events provide an opportunity to de-risk the energy transition through consistent policy that enables countries to work together, ensuring that the global community can tackle the challenges and opportunities of the energy transition as a united front.

Keeping net-zero ambitions on track

Despite the challenges faced by the energy sector, the latest research reveals a key positive: 91 percent of energy leaders surveyed are working towards achieving net zero. This demonstrates a strong commitment to the transition and clear recognition of its importance. It also emphasizes the need to accelerate our efforts, streamline processes, and reduce barriers to realizing net-zero ambitions — and further underscores the need to de-risk energy transition investment by removing uncertainties.

The solution is collaborating and harmonizing our goals with the main players in the energy sector across the private and public sectors, while establishing consistent, transparent, and supportive policy frameworks that encourage investment and drive technological innovation.

These tasks, while daunting, are achievable. They require vision, leadership, and action from all stakeholders involved. By adopting a new mindset about how we participate in the energy system and what our obligations are, we can stimulate the rapid progress needed on the road to net zero.

Dr. Tej Gidda (Ph.D., M.Sc., BSc Eng) is an educator and engineer with over 20 years of experience in the energy and environmental fields. As GHD Global Leader – Future Energy, Tej is passionate about moving society along the path towards a future of secure, reliable, and affordable low-carbon energy. His focus is on helping public and private sector clients set and deliver on decarbonization goals in order to achieve long-lasting positive change for customers, communities, and the climate. Tej enjoys fostering the next generation of clean energy champions as an Adjunct Professor at the University of Waterloo Department of Civil and Environmental Engineering.

GHD | www.ghd.com

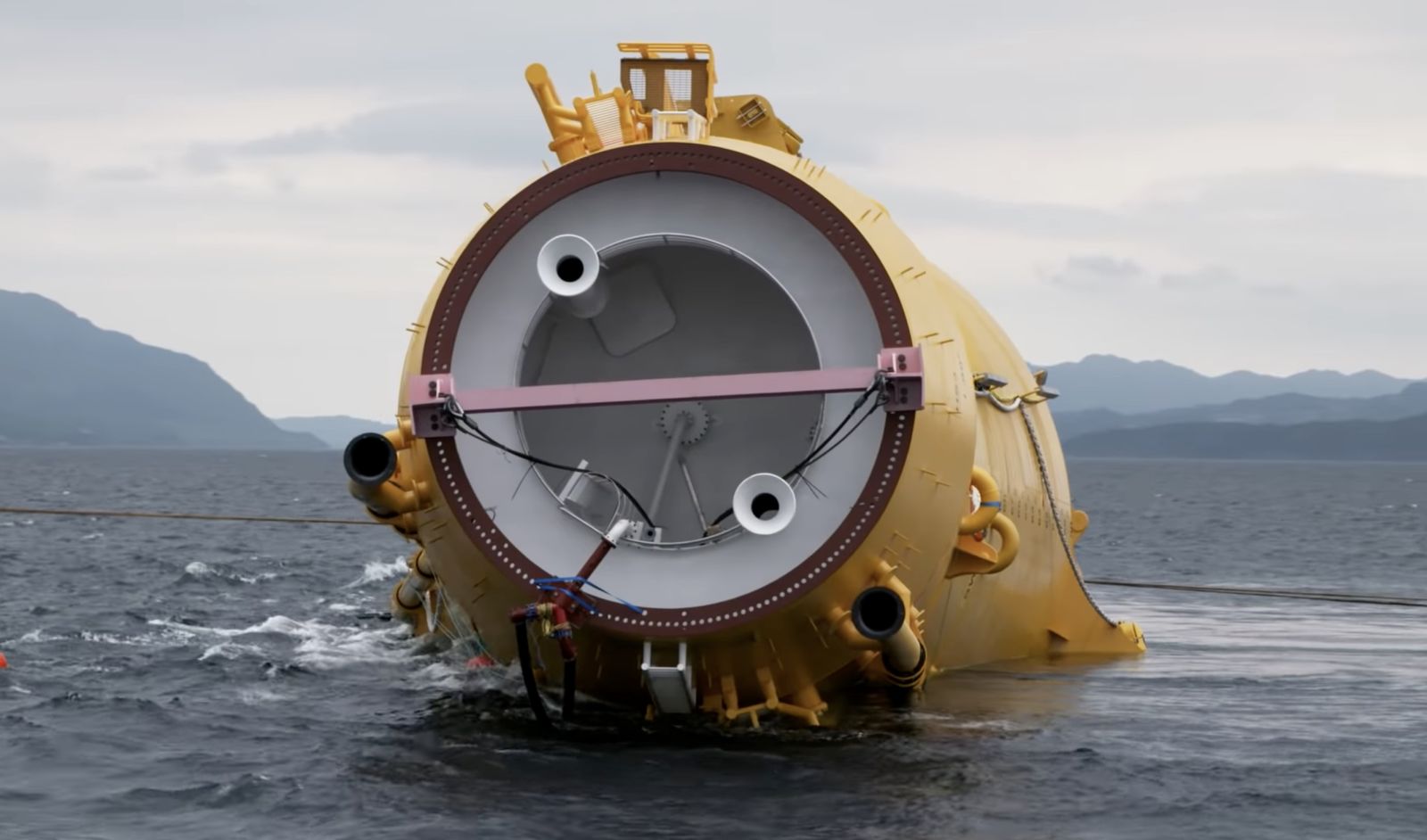

The Kincardine floating wind farm, located off the east coast of Scotland, was a landmark development: the first commercial-scale project of its kind in the UK sector. Therefore, it has been closely watched by the industry throughout its installation. With two of the turbines now having gone through heavy maintenance, it has also provided valuable lessons into the O&M processes of floating wind projects.

In late May, the second floating wind turbine from the five-turbine development arrived in the port of Massvlakte, Rotterdam, for maintenance. An Anchor Handling Tug Supply (AHTS)

vessel was used to deliver the KIN-02 turbine two weeks after a Platform Supply Vessel (PSV) and AHTS had worked to disconnect the turbine from the wind farm site. The towing vessel became the third vessel used in the operation.

This is not the first turbine disconnected from the site and towed for maintenance. In the summer of 2022, KIN-03 became the world’s first-ever floating wind turbine that required heavy maintenance (i.e. being disconnected and towed for repair). It was also towed from Scotland to Massvlakte.

Each of these operations has provided valuable lessons for the ever-watchful industry in how to navigate the complexities of heavy maintenance in floating wind as the market segment grows.

The heavy maintenance process

When one of Kincardine’s five floating 9.5 MW turbines (KIN-03) suffered a technical failure in May 2022, a major technical component needed to be replaced. The heavy maintenance strategy selected by the developer and the offshore contractors consisted in disconnecting and towing the turbine and its floater to Rotterdam for maintenance, followed by a return tow and re-connection. All of the infrastructure, such as crane and tower access, remained at the quay following the construction phase. (Note, the following analysis only covers KIN-03, as details of the second turbine operation are not yet available).

Comparing the net vessel days for both the maintenance and the installation campaigns at this project highlights how using a dedicated marine spread can positively impact operations.

For this first-ever operation, a total of 17.2 net vessel days were required during turbine reconnection—only a slight increase on the 14.6 net vessel days that were required for the first hook-up operation performed during the initial installation in 2021. However, it exceeds the average of eight net vessel days during installation. The marine spread used in the heavy maintenance operation differed from that used during installation. Due to this, it did not benefit from the learning curve and experience gained throughout the initial installation, which ultimately led to the lower average vessel days.

The array cable re-connection operation encountered a similar effect. The process was performed by one AHTS that spent 10 net vessel days on the operation. This compares to the installation campaign, where the array cable second-end pull-in lasted a maximum of 23.7 hours using a cable layer.

Overall, the turbine shutdown duration can be broken up as 14 days at the quay for maintenance, 52 days from turbine disconnection to turbine reconnection, and 94 days from disconnection to the end of post-reconnection activities.

What developers should keep in mind for heavy maintenance operations

This analysis has uncovered two main lessons developers should consider when planning a floating wind project: the need to identify an appropriate O&M port, and to guarantee that a secure fleet is available.

Floating wind O&M operations require a port with both sufficient room and a deep-water quay. The port must also be equipped with a heavy crane with sufficient tip height to accommodate large floaters and reach turbine elevation. Distance to the wind farm should also be taken into account, as shorter distances will reduce towing time and, therefore, minimize transit and non-productive turbine time.

During the heavy maintenance period for KIN-03 and KIN-02, the selected quay (which had also been utilized in the initial installation phase of the wind farm project), was already busy as a marshalling area for other North Sea projects. This complicated the schedule significantly, as the availability of the quay and its facilities had to be navigated alongside these other projects. This highlights the importance of abundant quay availability both for installation (long-term planning) and maintenance that may be needed on short notice.

At the time of the first turbine’s maintenance program (June 2022), the North Sea AHTS market was in an exceptional situation: the largest bollard pull AHTS units contracted at over $200,000 a day, the highest rate in over a decade.

During this time, the spot market was close to selling out due to medium-term commitments, alongside the demand for high bollard pull vessels for the installation phase at a Norwegian floating wind farm project. The Norwegian project required the use of four AHTS above a 200t bollard pull. With spot rates ranging from $63,000 to $210,000 for the vessels contracted for Kincardine’s maintenance, the total cost of the marine spread used in the first repair campaign was more than $4 million.

Developers should therefore consider the need to structure maintenance contracts with AHTS companies, either through frame agreements or long-term charters, to decrease their exposure to spot market day rates as the market tightens in the future.

While these lessons are relevant for floating wind developers now, new players are looking towards alternative heavy O&M maintenance options for the future. Two crane concepts are especially relevant in this instance. The first method is for a crane to be included in the turbine nacelle to be able to directly lift the component which requires repair from the floater, as is currently seen on onshore turbines. This method is already employed in onshore turbines and could be applicable for offshore. The second method is self-elevating cranes with several such solutions already in development.

The heavy maintenance operations conducted on floating turbines at the Kincardine wind farm have provided invaluable insights for industry players, especially developers. The complex process of disconnecting and towing turbines for repairs highlights the need for meticulous planning and exploration of alternative maintenance strategies, some of which are already in the pipeline. As the industry evolves, careful consideration of ports, and securing fleet contracts, will be crucial in driving efficient and cost-effective O&M practices for the floating wind market.

Sarah McLean is Market Research Analyst at Spinergie, a maritime technology company specializing in emission, vessel performance, and operation optimization.

Spinergie | www.spinergie.com

According to the Energy Information Administration (EIA), developers plan to add 54.5 gigawatts (GW) of new utility-scale electric generating capacity to the U.S. power grid in 2023. More than half of this capacity will be solar. Wind power and battery storage are expected to account for roughly 11 percent and 17 percent, respectively.

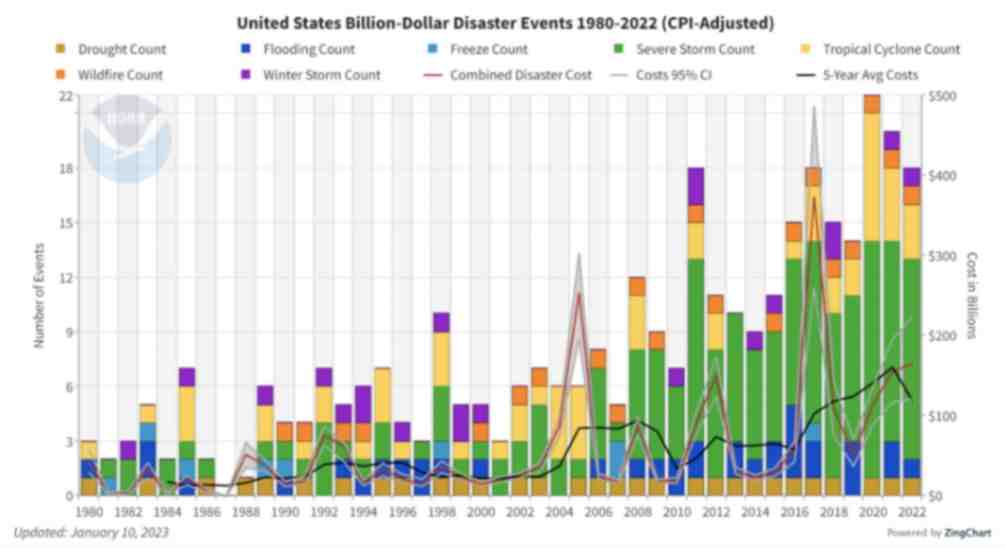

A large percentage of new installations are being developed in areas that are prone to extreme weather events and natural disasters (e.g., Texas and California), including high wind, tornadoes, hail, flooding, earthquakes, wildfires, etc. With the frequency and severity of many of these events increasing, project developers, asset owners, and tax equity partners are under growing pressure to better understand and mitigate risk.

Figure 1. The history of billion-dollar disasters in the United States each year from 1980 to 2022 (source: NOAA)

In terms of loss prevention, a Catastrophe (CAT) Modeling Study is the first step to understanding the exposure and potential financial loss from natural hazards or extreme weather events. CAT studies form the foundation for wider risk management strategies, and have significant implications for insurance costs and coverage.

Despite their importance, developers often view these studies as little more than a formality required for project financing. As a result, they are often conducted late in the development cycle, typically after a site has been selected. However, a strong case can be made for engaging early with an independent third party to perform a more rigorous site-specific technical assessment. Doing so can provide several advantages over traditional assessments conducted by insurance brokerage affiliates, who may not possess the specialty expertise or technical understanding needed to properly apply models or interpret the results they generate. One notable advantage of early-stage catastrophe studies is to help ensure that the range of insurance costs, which can vary from year to year with market forces, are adequately incorporated into the project financial projections.

The evolving threat of natural disasters

Over the past decade, the financial impact of natural hazard events globally has been almost three trillion dollars. In the U.S. alone, the 10-year average annual cost of natural disaster events exceeding $1 billion increased more than fourfold between the 1980s ($18.4 billion) and the 2010s ($84.5 billion).

Investors, insurers, and financiers of renewable projects have taken notice of this trend, and are subsequently adapting their behavior and standards accordingly. In the solar market, for example, insurance premiums increased roughly four-fold from 2019 to 2021. The impetus for this increase can largely be traced back to a severe storm in Texas in 2019, which resulted in an $80 million loss on 13,000 solar panels that were damaged by hail.

The event awakened the industry to the hazards severe storms present, particularly when it comes to large-scale solar arrays. Since then, the impact of convective weather on existing and planned installations has been more thoroughly evaluated during the underwriting process. However, far less attention has been given to the potential for other natural disasters; events like floods and earthquakes have not yet resulted in large losses and/or claims on renewable projects (including wind farms). The extraordinary and widespread effect of the recent Canadian wildfires may alter this behavior moving forward.

A thorough assessment, starting with a CAT study, is key to quantifying the probability of their occurrence — and estimating potential losses — so that appropriate measures can be taken to mitigate risk.

All models are not created equal

Industrywide, certain misconceptions persist around the use of CAT models to estimate losses from an extreme weather event or natural disaster.

Often, the perception is that risk assessors only need a handful of model inputs to arrive at an accurate figure, with the geographic location being the most important variable. While it’s true that many practitioners running models will pre-specify certain project characteristics regardless of the asset’s design (for example, the use of steel moment frames without trackers for all solar arrays in a given region or state), failure to account for even minor details can lead to loss estimates that are off by multiple orders of magnitude.

The evaluation process has recently become even more complex with the addition of battery energy storage. Relative to standalone solar and wind farms, very little real-world experience and data on the impact of extreme weather events has been accrued on these large-scale storage installations. Such projects require an even greater level of granularity to help ensure that all risks are identified and addressed.

Even when the most advanced modeling software tools are used (which allow for thousands of lines of inputs), there is still a great deal that is subject to interpretation. If the practitioner does not possess the expertise or technical ability needed to understand the model, the margin for error can increase substantially. Ultimately, this can lead to overpaying for insurance. Worse, you may end up with a policy with insufficient coverage. In both cases, the profitability of the asset is impacted.

Supplementing CAT studies

In certain instances, it may be necessary to supplement CAT models with an even more detailed analysis of the individual property, equipment, policies, and procedures. In this way, an unbundled risk assessment can be developed that is tailored to the project. Supplemental information (site-specific wind speed studies and hydrological studies, structural assessment, flood maps, etc.) can be considered to adjust vulnerability models.

This provides an added layer of assurance that goes beyond the pre-defined asset descriptions in the software used by traditional studies or assessments. By leveraging expert elicitations, onsite investigations, and rigorous engineering-based methods, it is possible to discretely evaluate asset-specific components as part of the typical financial loss estimate study: this includes Normal Expected Loss (NEL), also known as Scenario Expected Loss (SEL); Probable Maximum Loss (PML), also known as Scenario Upper Loss (SUL); and Probabilistic Loss (PL).

Understanding the specific vulnerabilities and consequences can afford project stakeholders unique insights into quantifying and prioritizing risks, as well as identifying proper mitigation recommendations.

Every project is unique

The increasing frequency and severity of natural disasters and extreme weather events globally is placing an added burden on the renewable industry, especially when it comes to project risk assessment and mitigation. Insurers have signaled that insurance may no longer be the main basis for transferring risk; traditional risk management, as well as site and technology selection, must be considered by developers, purchasers, and financiers.

As one of the first steps in understanding exposure and the potential capital loss from a given event, CAT studies are becoming an increasingly important piece of the risk management puzzle. Developers should treat them as such by engaging early in the project lifecycle with an independent third-party practitioner with the specialty knowledge, tools, and expertise to properly interpret models and quantify risk.

Hazards and potential losses can vary significantly depending on the project design and the specific location. Every asset should be evaluated rigorously and thoroughly to minimize the margin for error, and maximize profitability over its life.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

Chris LeBoeuf is Global Head of the Extreme Loads and Structural Risk division of ABS Group, based in San Antonio, Texas. He leads a team of more than 60 engineers and scientists in the US, UK, and Singapore, specializing in management of risks to structures and equipment related to extreme loading events, including wind, flood, seismic and blast. Chris has more than 20 years of professional experience as an engineering consultant, and is a recognized expert in the study of blast effects and blast analysis, as well as design of buildings. He holds a Bachelor of Science in Civil Engineering from The University of Texas at San Antonio, and is a registered Professional Engineer in 12 states.

ABS Group | www.abs-group.com

Throughout my life and career as a real estate developer in New York City, I’ve had many successes. In what is clearly one of my most unusual development projects in a long career filled with them, I initiated the building of a solar farm to help t....

I’m just going to say it, BIPV is dumb. Hear me out…. Solar is the most affordable form of energy that has ever existed on the planet, but only because the industry has been working towards it for the past 15 years. Governments,....

Heat waves encircled much of the earth last year, pushing temperatures to their highest in recorded history. The water around Florida was “hot-tub hot” — topping 101° and bleaching and killing coral in waters around the peninsula. Phoenix had ....

Wind turbines play a pivotal role in the global transition to sustainable energy sources. However, the harsh environmental conditions in which wind turbines operate, such as extreme temperatures, high humidity, and exposure to various contaminants, p....

Wind energy remains the leading non-hydro renewable technology, and one of the fastest-growing of all power generation technologies. The key to making wind even more competitive is maximizing energy production and efficiently maintaining the assets. ....

The allure of wind turbines is undeniable. For those fortunate enough to visit these engineering marvels, it’s an experience filled with awe and learning. However, the magnificence of these structures comes with inherent risks, making safety an abs....

Battery energy storage is a critical technology to reducing our dependence on fossil fuels and build a low carbon future. Renewable energy generation is fundamentally different from traditional fossil fuel energy generation in that energy cannot be p....

Not enough people know that hydrogen fuel cells are a zero-emission energy technology. Even fewer know water vapor's outsized role in electrochemical processes and reactions. Producing electricity through a clean electrochemical process with water....

In the ever-evolving landscape of sustainable transportation, a ground-breaking shift is here: 2024 ushers in a revolutionary change in Electric Vehicle (EV) tax credits in the United States. Under the Inflation Reduction Act (IRA), a transforma....

Now more than ever, it would be difficult to overstate the importance of the renewable energy industry. Indeed, it seems that few other industries depend as heavily on constant and rapid innovation. This industry, however, is somewhat unique in its e....

University of Toronto’s latest student residence welcomes the future of living with spaces that are warmed by laptops and shower water. In September 2023, one of North America’s largest residential passive homes, Harmony Commons, located....

For decades, demand response (DR) has proven a tried-and-true conservation tactic to mitigate energy usage during peak demand hours. Historically, those peak demand hours were relatively predictable, with increases in demand paralleling commuter and ....